Blogs

ICAI CA New Scheme of Education

ICAI (Institute of Chartered Accountants of India) has recently unveiled the CA New Scheme 2023, officially notified in the Gazette of India on June 22, 2023, and set to be implemented from July 1, 2023. This scheme brings about significant changes in the CA course curriculum and practical training duration. In this article, we will delve into the intricacies of the ICAI CA New Scheme of Education, including the latest updates and a comparison between the old and new schemes.

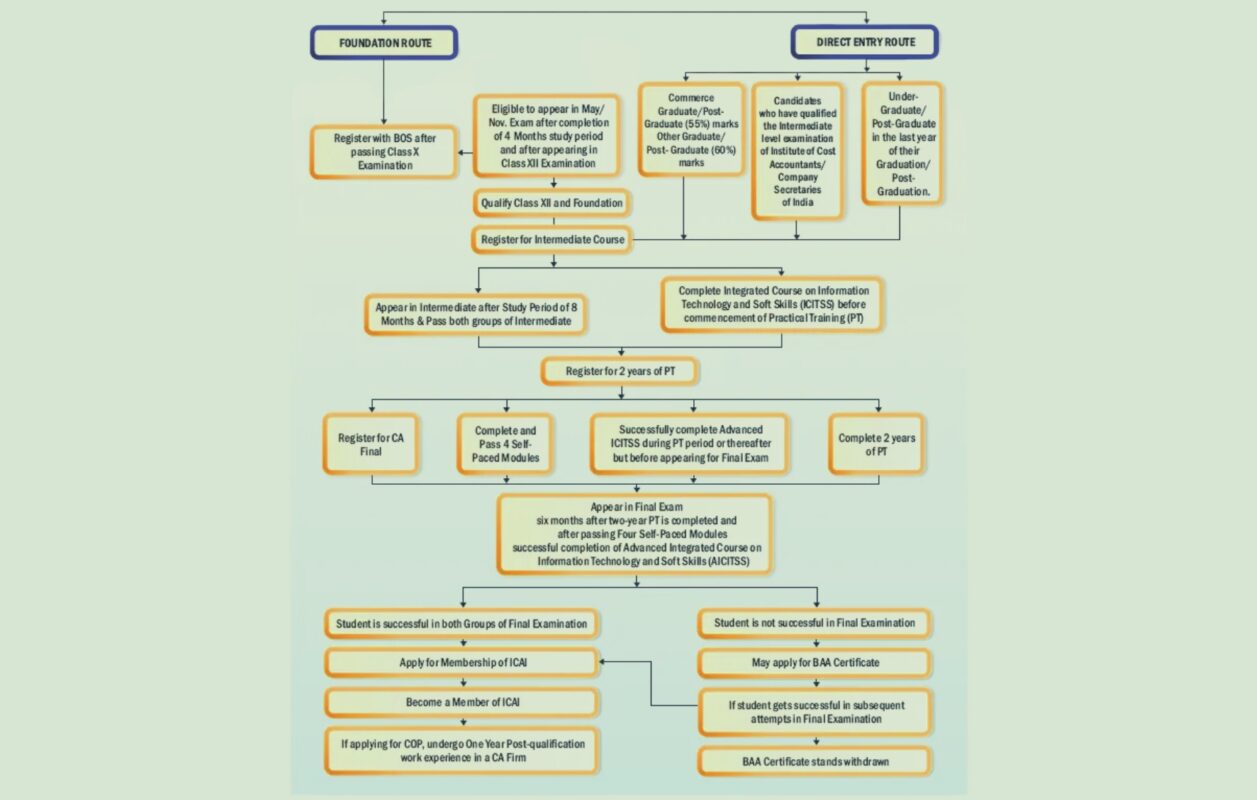

The CA New Scheme of education and training introduced by ICAI encompasses all three levels of the CA course: CA Foundation, CA Intermediate, and CA Final. Under this new scheme, several changes have been made concerning syllabus, subjects, registration validity, and passing criteria. Let’s explore these alterations at each level.

ICAI CA New Scheme 2023 at a Glance

The details of the CA New Scheme are outlined in the following image:

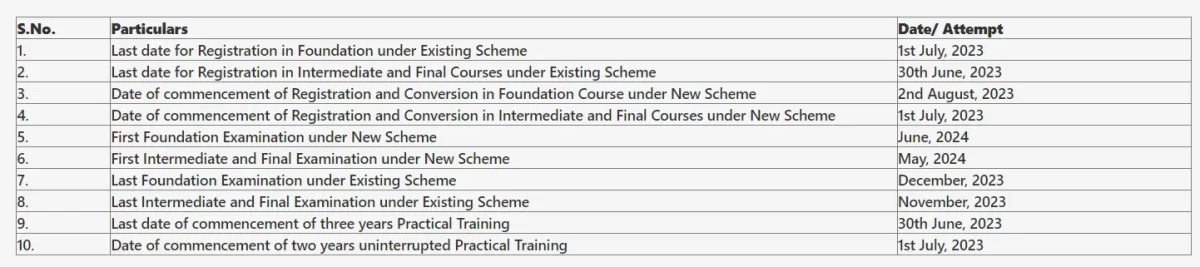

Important Dates for ICAI CA New Scheme 2023

ICAI has officially declared that the CA New Scheme 2023 will be applicable from the May 2024 attempt. The date of execution for the CA New Course is set for July 1, 2023. Initially, the implementation was planned for the November 2023 attempt, but due to delays in obtaining Ministry of Corporate Affairs (MCA) approval, it has been postponed to the May 2024 attempt. For specific dates regarding the CA New Scheme’s education and training, refer to the image below:

Latest Updates

ICAI launched the CA New Scheme on July 1, 2023, and it is now applicable from the May 2024 attempt. Students who cleared Group 1 of CA Intermediate in the old course and wish to appear in the CA New Course for the May 2024 exams will be exempted from the cost and advanced accountancy papers. They will only need to take the Audit and FMSM exams.

CA Foundation New Course

The proposed CA New Scheme 2023 introduces changes to the CA Foundation course’s eligibility, registration validity, syllabus, and pass percentage. The modifications include:

CA Foundation Eligibility

Under the CA New Scheme 2023, ICAI has altered the CA Foundation eligibility criteria. Students can now appear in the CA Foundation examination after clearing their class 12th boards and completing a minimum study period of 4 months.

CA Foundation Registration Validity

In the CA New Scheme 2023, the registration validity for the CA Foundation course is set at 4 years. Students must complete the foundation course within this timeframe. Failure to pass the CA Foundation level within this period will necessitate choosing the CA direct entry route to continue the CA course. As a result, students must plan their studies accordingly and aim to pass their CA Foundation exams within the stipulated timeframe.

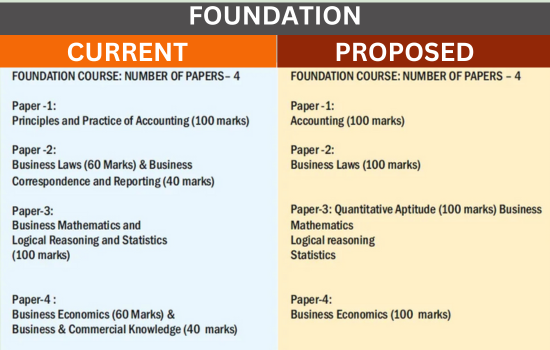

CA Foundation New Syllabus

The current CA course includes 6 subjects and 4 papers in the CA Foundation syllabus. However, the new course eliminates two subjects, namely “Business Correspondence & Reporting” and “Business & Commercial Knowledge.” The CA Foundation’s new syllabus comprises the following subjects:

CA Foundation Pass Percentage

In the CA New Scheme 2023, the CA Foundation passing percentage criteria have been modified. Students are now required to secure 50% marks to pass the CA Foundation exams. Additionally, ICAI has implemented a negative marking system of 0.25 for each incorrect MCQ answer in the CA New Course. These changes aim to ensure students possess a profound understanding of concepts and can apply them effectively. Therefore, students must extensively practice CA Foundation mock test papers before appearing for the exams.

CA Intermediate New Course

Under the proposed scheme, ICAI has introduced several changes to the CA Intermediate course, which include:

CA Intermediate Eligibility

The CA Intermediate eligibility criteria remain unchanged in the new scheme. Students can appear for the exams after completing the CA Foundation course or through the direct entry route. However, students following the direct entry route must undergo an 8-month study period before attempting the exams.

CA Intermediate Registration Validity

The registration validity for CA Intermediate has been extended from 4 years to 5 years in the new scheme. Students can now revalidate their registration by paying a prescribed fee just once. This change allows students more time to complete the CA Intermediate course and sit for the exams.

CA Intermediate New Syllabus 2023

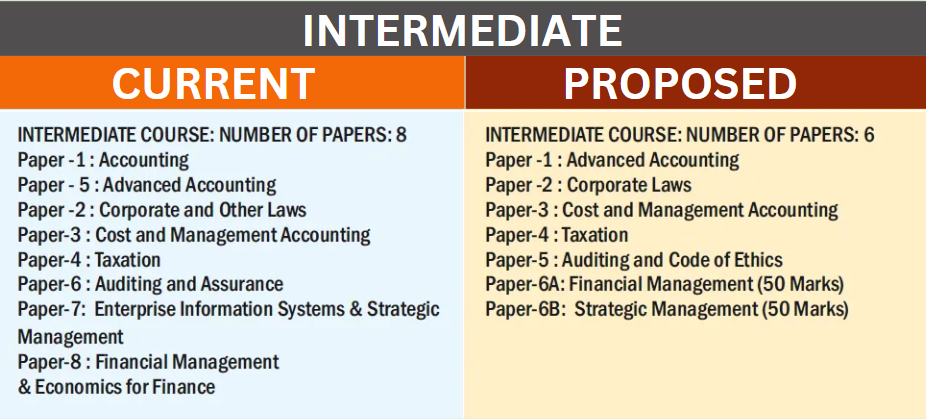

In the CA Intermediate course, the paper count has been reduced. The CA Intermediate syllabus will now consist of 6 papers instead of 8. ICAI has merged “Corporate & Other Laws” from the foundation level with “Business Law,” and “Enterprise Information Systems & Strategic Management” from the intermediate level with subjects of the final level. The revised CA Intermediate course now includes the following:

CA Intermediate Pass Percentage

In the CA New Scheme 2023, the CA Intermediate passing percentage criteria have also changed. Each paper will comprise 30% MCQs and 70% descriptive questions. Additionally, a negative marking of 25% will apply for each incorrect MCQ response. Consequently, students must refrain from guessing and improve their preparation and application skills to handle MCQ-based questions effectively.

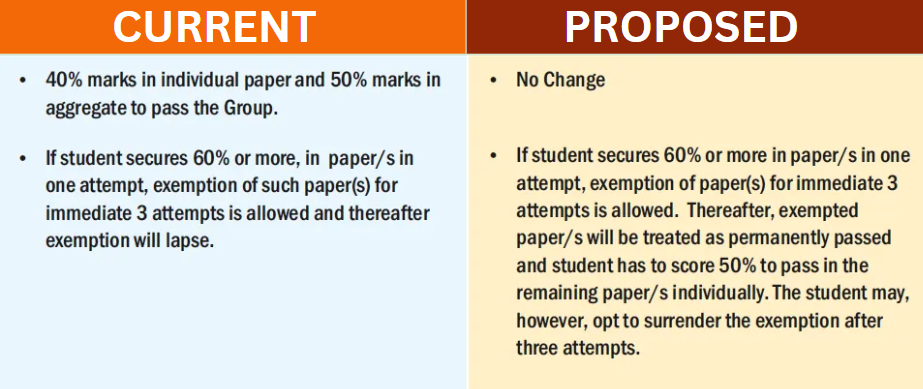

CA Intermediate Exemption

Following the application of the CA New Scheme 2023, students scoring 60% or more in papers in one attempt will be eligible for exemption for the next 3 attempts. Beyond that, students will be permanently exempted and must score at least 50% marks to pass the remaining papers individually.

CA Articleship Under CA New Scheme 2023

ICAI has proposed important changes to CA Articleship training that will be advantageous for students:

CA Articleship Duration

The duration of CA articleship will be reduced from 3 to 2 years in the CA New Scheme. This change will enable students to become chartered accountants earlier. Moreover, students can register for the CA final examination after completing their practical training and 6 months of study.

ICAI Practical Training Eligibility

To become eligible for CA articleship under the CA New Scheme 2023, students must clear both groups of CA Intermediate level and complete the ICITSS training. This change allows students to pursue CA articleship without being preoccupied with remaining and further attempts.

CA Articleship Stipend Criteria

With the implementation of the new course, ICAI has increased the stipend for articles to 100%.

CA Articleship Leaves

Under the new course, students no longer have to take any exams during their CA articleship. However, ICAI has restricted the number of leaves allowed. Students can now take only 12 leaves per year and 24 leaves throughout their complete training period.

Introduction of COP in Articleship

With the reduced time period of practical training, a condition has been introduced for aspirants who wish to become practitioners. They must hold 1 year of experience in a Chartered Accountancy firm to obtain a Certificate of Practice or COP.

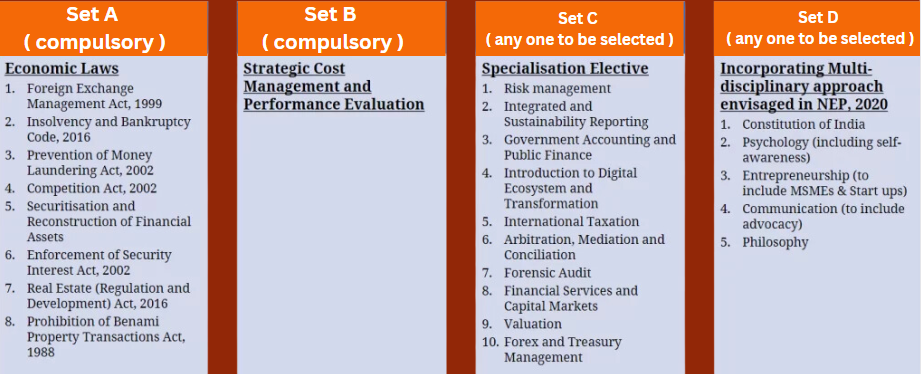

Introduction of ICAI Self-Paced Online Modules

Under the CA New Course 2023, ICAI will introduce self-paced modules divided into four sets. Students must complete all sets at their own pace and achieve a minimum score of 50% in each set to become eligible for the CA final level.

Students can find a brief description of all the sets in the image below:

CA Final New Course

ICAI has made significant changes to the CA Final course eligibility, registration validity, new syllabus, pass percentage, and exemption, which are described as follows:

CA Final Eligibility

To be eligible for the CA Final course, students must fulfill the following criteria:

- Pass both groups of CA Intermediate level and complete the ICITSS training.

- Pass all sets of self-paced modules with more than 50% marks in each set.

- Complete 6 months of study period after completing practical training.

CA Final Registration Validity

The registration for CA Final is now valid for 10 years. Students can revalidate their registration after 10 years by paying prescribed fees.

CA Final New Syllabus 2023

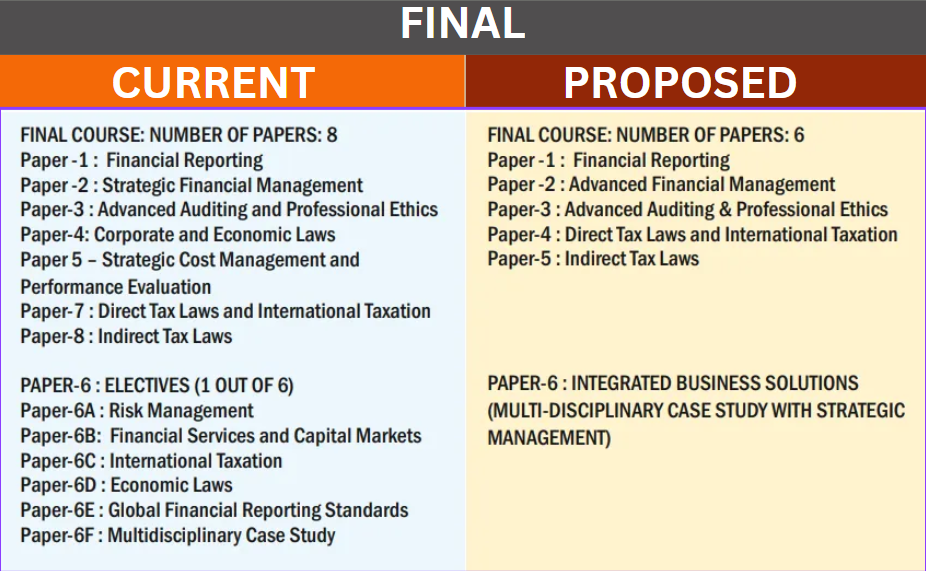

The number of papers in the CA Final syllabus has been reduced from 8 to 6. Both CA Final-level groups will now include 3 papers each.

The changes applied in the CA Foundation study materials are as follows:

- Papers 4 and 5 subjects will be removed and included in the first set of self-paced modules.

- Multi-disciplinary case studies with strategic management will be compulsory in Paper 6, which will have no further options now.

- Elective subjects such as risk management, financial services, and capital markets will be included in the SET-C of the self-paced online module.

CA Final Pass Percentage

The CA Final pass percentage remains the same as the CA Intermediate level. All 6 papers will have 30% MCQs and 70% descriptive questions. A negative marking of 25% will apply for each incorrect MCQ.

CA Final Exemption

The exemption rules for the CA Final level are also the same as the CA Intermediate level. Students need to score 60% or more in papers in one attempt to be eligible for permanent exemption for the next 3 attempts. To pass the remaining papers individually, students must score at least 50%.

Exit Route Under CA New Scheme

In the new scheme of education and training, ICAI has also modified the exit route. Previously, students exited the CA course due to their inability to crack the CA Final exams. Additionally, ICAI will introduce a new certification called Business Accounting Associate in the new scheme.

To attain the Business Accounting Associate certification, students must meet the following criteria:

- Pass both groups of CA Intermediate level.

- Complete 2 years of CA Articleship.

- Complete AICTSS Training.

- Qualify for all the sets of self-paced online modules.

Conclusion

The above article provides comprehensive information regarding the CA New Scheme of education and training. Regular updates on CA New Scheme 2023 from ICAI will be provided. As the new scheme takes effect from the May 2024 exams, students are advised to prepare themselves for the upcoming changes and utilize available resources effectively.